To pay bills, save for the future, and keep track of your financial health, you probably need to start by opening a bank account. If you open a bank account in your name, you have the right to access it anytime. But if you get married, you might wonder whether your spouse has access to your bank account.

Only the account holder has the right to access their bank account. If you have a joint bank account, you both own the account and have access to the funds. But in the case of a personal bank account, your spouse has no legal right to access it.

When a married couple opens a joint account together, they both have equal access to funds without each other’s consent. Regular bank accounts, on the other hand, are owned by one person who has complete control over the account.

Only the account holder can authorize transactions to and from that account. For a spouse to access their partner’s bank account, there must be a specific and legally recognized reason for doing so, like when they have been granted power of attorney or they are the main beneficiary of that account.

Bank policies also play a role in determining a spouse’s access to their partner’s bank account. Some banks may allow a spouse to access certain account information, such as account balances and transaction history, but not allow them to make transactions or access funds.

Joint bank account holders have the right to withdraw funds without consent. But if only one person opened the bank account, the other spouse lacks the legal right to withdraw funds from the account.

Banks only release bank statements to the account holder, and your spouse cannot view them without your consent. In the case of joint accounts, both account holders have equal rights to access the account information and joint bank account statements.

Marriage does not automatically give a spouse the right to access their partner’s credit reports without their consent. Credit reports are considered personal and confidential information with restricted access. No other person can view your credit report unless they have a permissible purpose for doing so.

Permissible purpose refers to legally allowed access to another person’s credit report, such as for loan applications or to check the creditworthiness of a tenant or employee. Marriage, by itself, is not considered a permissible purpose for accessing a credit report.

During divorce proceedings, both parties must produce financial statements as part of the discovery process. The court uses the information in these documents to make decisions related to child support, alimony, and property division.

A power of attorney (POA) is a legal document that gives someone the authority to act on behalf of another person in terms of legal and financial matters. If your spouse has been granted power of attorney for you, they should be able to access your bank account as long as the POA follows the laws of the state.

Having separate bank accounts in marriage depends on the couple’s individual circumstances and financial goals. However, many financial experts recommend that couples maintain separate bank accounts to preserve a sense of financial independence. Separate bank accounts can be particularly beneficial in situations where one spouse has severe debts and financial obligations or where there are trust issues present.

If you notice that your spouse has a secret bank account, it is advisable to handle the situation with sensitivity and caution. A spouse may keep a secret bank account for various reasons such as seeking financial independence, establishing a savings fund for emergencies, or prioritizing personal privacy. Before making any conclusions, have an honest conversation with your partner to express your concerns. Discuss the reasons your partner may have chosen to open a separate bank account and evaluate whether they are reasonable.

For couples to be financially transparent, they need to be upfront about their earnings, expenses, and existing debts. Couples should also consider opening a joint bank account as it provides an opportunity to monitor each other’s spending habits and ensure that you are both on the same page when it comes to managing your finances.

As long as a bank account is in your name alone, it is strictly off-limits to anyone else, including your spouse. If you want to share financial responsibilities with your spouse, the best option is to open a joint account together. It is crucial to understand that discussions around finances should be an ongoing dialogue between partners. You should both come up with a financial plan which you both feel comfortable with to secure your financial future.

The best way to legally hide money from your spouse is by opening a personal bank account. As long as the account is in your name, it is illegal for another person to make transactions from it without your authorization.

Opening a secret bank account is not advisable, as it can lead to a breakdown of trust in relationships. The best way to manage your finances is through collaboration and mutual understanding between partners.

If your wife or husband won’t share financial information, it is important to discuss the situation in an open and respectful manner. You can also seek advice from a financial adviser, who can provide guidance on how to work through your financial differences and reach a solution that works for both of you.

Written by Anna Yen Anna Yen, CFA, has nearly 2 decades of experience in financial markets, primarily with JPMorgan and UBS. Currently, she manages digital assets and her goal at FamilyFI is to empower families with financial literacy. She’s worked in 5 countries and visited 57.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. For more information about MoneyLion, please visit https://www.moneylion.com/terms-and-conditions/ .

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, MoneyLion does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information. For more information about MoneyLion, please visit https://www.moneylion.com/terms-and-conditions/.

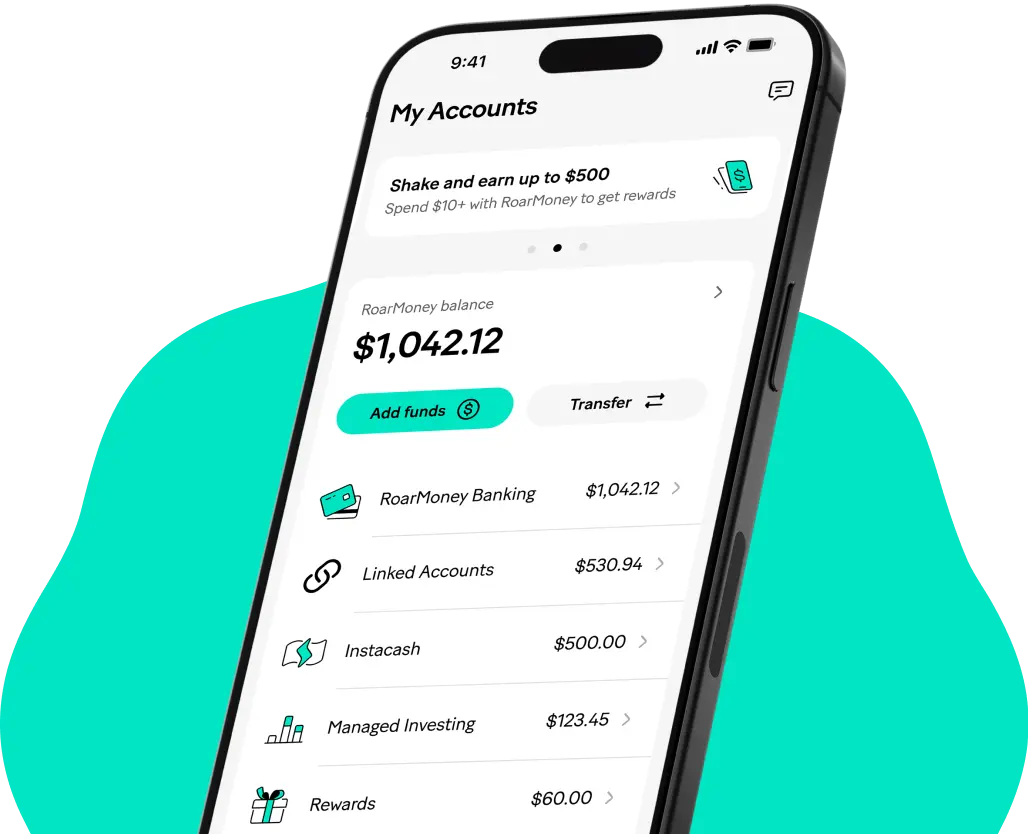

Get Instacash advances up to $500 for everyday expenses or life’s surprises. There’s no credit check, no monthly fee, and no interest.

![]()

![]()

![]()

![]()

![]()

TikTok

![]()

![]()

![]()

![]()

![]()

YouTube

MoneyLion NMLS ID 1237506

© 2013 - 2024, MoneyLion Inc. All Rights Reserved.